Our Humble Beginnings

Cebu People’s Multi-Purpose Cooperative (CPMPC), widely known as People’s Coop, was organized by the Scarborough fathers on December 21, 1972, through the efforts of VICTO. It was then held the first office at Room 209 J. Borromeo Building, F. Ramos Street, Cebu City.

People’s Coop started with 27 members with a total initial share capital of two thousand one hundred seventy-five pesos and fifty-five centavos (P2,175.55). It was first registered with the Bureau of Agricultural Cooperative Development (BACOD) as a credit cooperative on December 5, 1975, under Registration No. FF-028, and with the Bureau of Internal Revenue (BIR) on October 26, 1993, with Registration No.: OCN 2RC000081612 (CDA) on October 28, 1993. And in compliance with RA 9520 or the New Philippine Cooperative Code of 2008, the same Authority issued to the Cooperative a new Certificate of Registration CIN-0102070773 on December 18, 2009.

The first decade of the People’s Cooperative was the most challenging. Like any budding organization, it also had its share of obstacles in various dimensions. Over its long years of existence, its trend of performance was jagged. It experienced its first bout of high loan delinquencies in 1976. Squabble among its Board of Directors (BOD) in 1978 exacerbated the problem. Factionalism within the leadership was so intense that it required three General Assemblies to settle.

The performance of the cooperative was erratic and unpredictable. Its business fundamentals were oftentimes bearish and poor. And as a consequence, by the end of 1985, membership slid to 906 from 1,500. These were sectors that demanded more access to the decision-making structure of the cooperative. They called for organizational reforms. They saw the need to restore the confidence of the members.

Fast forward following many years of hard work, the People’s Coop saw its light of successes and has become one of the most reputable cooperatives in the country.

“As a real social enterprise, we always put the interest of our members at the top of our priority and we believe that the sustainability of our cooperative is dependent on the values that rule in our cooperative & its leadership.”

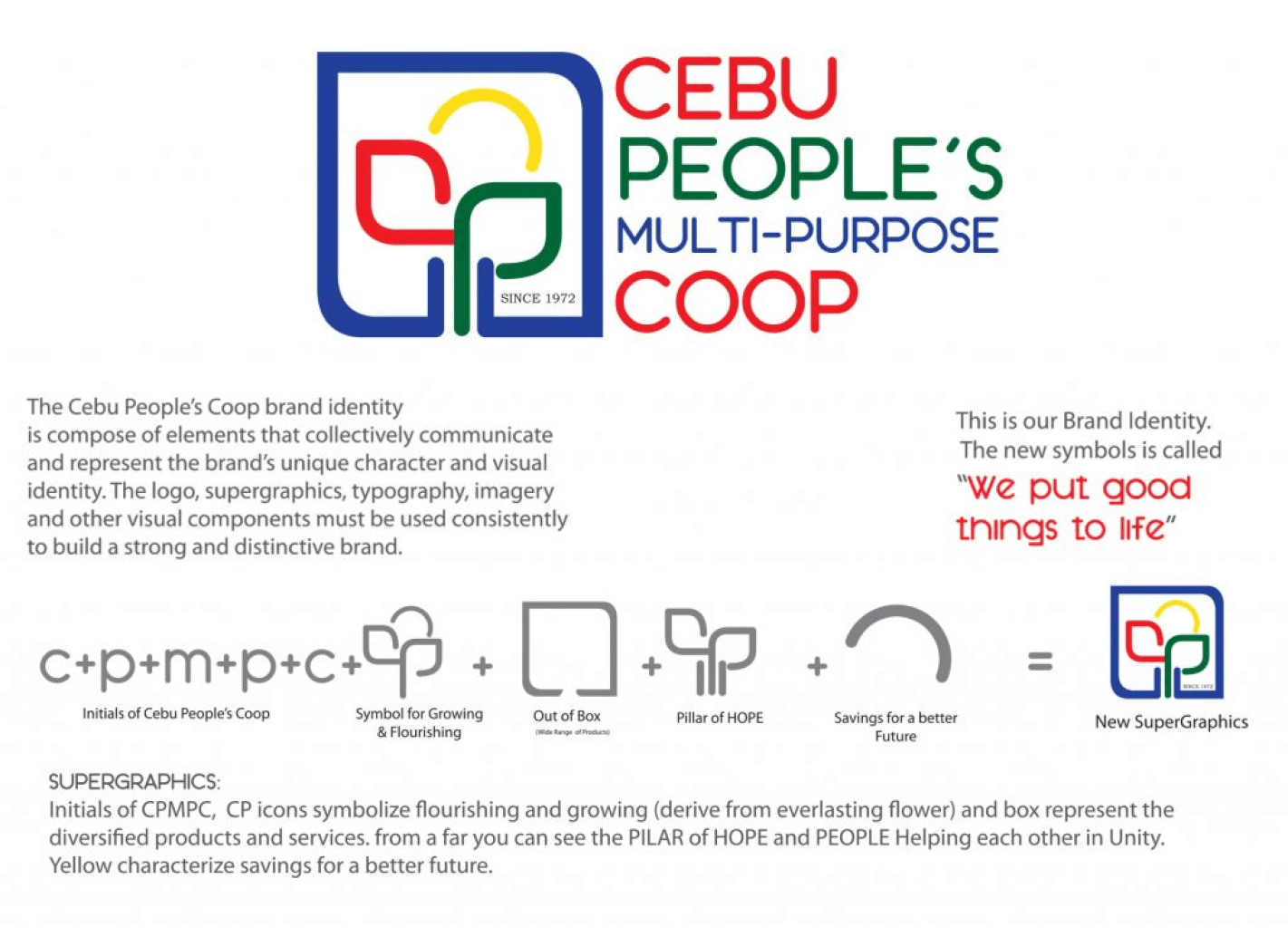

Brand Identity

Our Vision

"A leader in digital-based financially-inclusive services of socially-protected and delighted members."

Our Mission

We provide easy access to competitive financial services, appropriate technology, and resources that best satisfy the needs of the members, employees, community, and care for the environment

Core Values

Fairness

(Act without bias)

Accountability

(Own your action)

Transparency

(Being open & honest)

Excellence

(Doing your best)

Who We Are

A group of socially conscious individuals coming from all walks of life, regardless of their backgrounds, styles, gender, beliefs, and ideas, respecting and working together, committed to uplift the economic and social status of its members.

Set of Officers (2026 - 2027)

Frequently Asked Questions

- All Filipino citizens can be a member of Cebu People’s Cooperative.

- 18 years old and above.

- Below 18 years old can still be a member of CEYLABCO.

- CEYLABCO (CPMPC empowered Youth Laboratory Cooperative).

- Birth Certificate & Marriage Contract (if married)

- Barangay Clearance (Purpose: For membership of CPMPC)

- Latest colored ID picture (2 pcs 1x1 with white background)

- Proof of Address (ex: Electricity Bill)

- Tax Identification Number (TIN)

- Present valid ID (Preferably gov't issued ID i.e. driver's license, postal ID, SSS, etc.)

- Hospitalization Loan Services nationwide at accredited hospitals.

- Hospitalization Program

- College Education Program (SAVE NOW, STUDY, PAY LATER)

- ProEd Program

- Mortuary Services anywhere in the Philippines

- Damayan Program

- Credit Line and Hotels Discount Privileges

- Double Your Investment/Deposit up to php300K Insurance Coverage

- And other privileges as MIGS (Member-In-Good-Standing)

- TAX-FREE

- Savings Deposit

- Time Deposit

- Investment - Share Capital

- Investment - Preferred Share Capital

- Credit Services

- Business

- Consumer

- Personal

- others

- Dividend on Net Surplus

- Patronage Refund

- Membership Incentives

- Annual Contribution of Php 1,150.00 only:

- Hospitalization Program

- Damayan Program

- Membership Due

- CBU - Capital Build-Up at least 100 per month

- MR - Membership Referral/Recruitment

- On-time payment of Loan Obligation

- Building Fund Contribution